Marcus Ketter, CFO of the MDAX-listed GEA group, has had a successful start to his year. Within two years of targeting working capital, he cut down the GEA group’s working capital to sales ratio by almost two-thirds. Reducing net working capital from 906m EUR to 367m EUR has given them the flexibility they needed to move forward with the trust of the financial markets. Being named CFO of the month by the Finance Magazin is only the beginning – eleven months more of similarly impressive work could bring higher accolades and even more.

When advising businesses and executives, we at aioneers regularly see first-hand the value of understanding and improving working capital. If you are a potential ‘CFO of the Year’ looking for effective working capital management solutions, our working capital expert, Philipp Flemming*, has compiled some advice for you here.

The everyday unknown

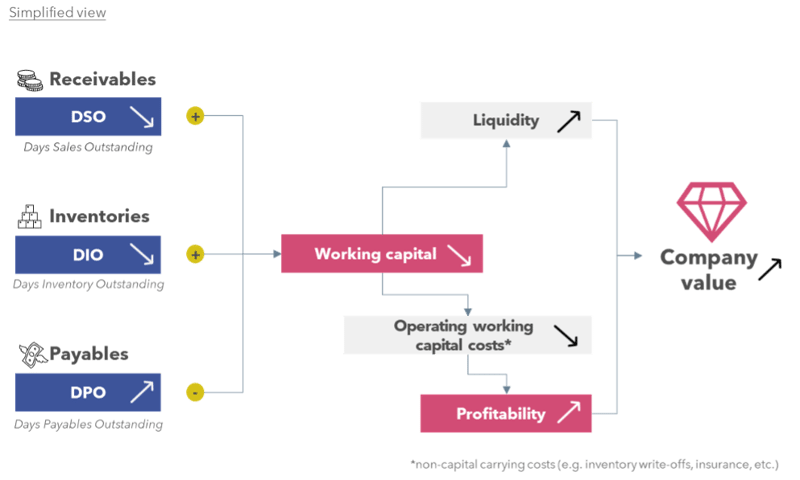

For far too many people, working capital is a vague “strategic something” that occurs every year to increase the availability of cash. The reality is a far more specific, value-creating, and hard-hitting process, and it certainly is not confined to one function’s workday. It’s about ensuring vital liquidity and the stability of financial independence, as well as significantly raising profitability. Ultimately, it is undetachable from your company’s value.

What does this mean?

The number of days between paying your suppliers and being paid by your customers is your cash-to-cash cycle, which is, in the end, your working capital. As this diagram shows, this is calculated using days sales outstanding (DSO), days inventory outstanding (DIO), and days payables outstanding (DPO). By reducing your DSO, right-sizing your DIO, and improving your DPO, you shorten your cash-to-cash cycle and reduce your working capital. The result is improved liquidity and lowered costs, such as inventory carrying costs, insurance, write-offs, and so on. Your company operates profitably, you become financially independent, and the value of your company increases. And as a nice side effect, your credit rating improves.

It’s a trap!

It’s easy to end up with bad working capital management. And like any affliction, it has its symptoms and root causes. CFOs ought to be analyzing these and searching for cures. Instead, we see them discovering unfavorable numbers after the second or third quarter. Late in the financial year, the reaction is to demand an immediate improvement in working capital, which typically results in short-term measures. As you can imagine, these measures – including purchase and payment stops, short-term safety stock reduction, fire sales, or a sudden emphasis on collecting overdue payments – absolutely do not amount to sustainable working capital optimization.

The descent can begin early. From an accounts receivable perspective, many companies struggle to get their invoices out in good time. Customers who pay on time are already paying later than is ideal, let alone those that pay late. We often see that clerks in these companies are tangled in time-consuming processes with unstandardized workflows when they could (or more accurately, should) be taking care of increasing the company’s cash inflow.

Mistakes are also easily made within the realm of inventory. They’re either too high or, in some instances, too low. Inaccurate planning parameters and poor forecasting may result in warehouses full of slow or non-moving inventory, leaving businesses unable to fulfill customer orders on time simply because the wrong products are in stock.

When it comes to accounts payable, an excessively high turnover ratio can have many causes. Settling supplier invoices too early (and too often), not drawing discounts, unfavorable and/or numerous payment terms; they all add up. Companies then face the financial stress of fulfilling obligatory and genuinely urgent payment obligations.

There is only one result to these consistent missteps. No matter the worth of the product, the strength of the marketing, or the genius of the employees: the company will require external financing.

The solution: 6 strategies that will win your CFO awards!

1. Create transparency and get your reporting in order

First of all, you can’t change what you can’t see. Many CFOs look at their companies’ balance sheet and want to understand why their working capital performance is poor. Without using your transactional data to build transparency, there’s no way of tracking your processes end-to-end nor ascertaining the real influencing factors on your working capital.

2. Set the “right” targets

Once you’ve got the data, you can start talking about your improvement objectives. That’s when the conflict begins. The problem isn’t exactly moving the goalposts, as it were – it’s the lack of a conscious, unanimously accepted decision as to where the goalposts ought to be built. For instance:

- Sales teams aim for higher sales demanding for high product availability

- Finance wants to have low inventories

- Production reduces its costs as much as possible by running on large batches resulting in stock build-up

- Procurement (still) looks for the best prices often resulting in high minimum order quantities

- And supply chain tries to make sure that the targets of low inventories and high product availability are met at the same time

It is possible, but it isn’t easy. Without any doubt, it takes creativity and experience. You need fixed goalposts aligned to your business strategy that apply a differentiated segmentation approach, along with a readiness to be ambitious with your working capital target.

3. Train your staff to improve your processes

Targets, once set, are there to be kept – by everyone. Your people are driving your working capital in their daily operations without truly being aware of the power of their actions. A customer once told us that of 30 people working for him, only a couple of them had the right skills and motivation to improve their processes. This may have been true, but it was by no means fixed. The key is to empower people. Show those working for you what positive effect they can have and exactly how they can achieve it, and the inefficiencies will begin to fade out. And with the motivation to automate manual tasks and so on, inaccurate planning will too phase out.

4. Apply guidelines and best practices

More often than not, big problems have small solutions. Guidelines are one of these. They should be clear, available, and consistently followed, while best practices should be analyzed and applied. Deploying the lean principle of standardized work is one of the most powerful, but least used lean tools. By documenting the current best practice, standardized work forms the baseline for continuous improvement. Improving standardized work should be a never-ending process, continually updating to new-found best practices and improving their quality.

5. Make it a management topic

As working capital is a cross-functional matter, we recommend anchoring working capital at the top level. Create a central working capital authority within your Finance & Controlling function, sponsored by your CFO. From here, all improvement initiatives should be coordinated and managed, covering the processes purchase-to-pay, forecast-to-fulfill, and order-to-cash. In addition, hire or educate qualified working capital champions with the expert knowledge needed to support working capital initiatives and train the people involved.

6. Communicate, communicate, communicate

Establish the right sense of urgency within your organization. Communicate the responsibility you want people to take, reminding them of their impressive capabilities. Your people are your best asset in getting your working capital where you want it, and your communication needs to show them exactly that. Keep your organization informed, accompanying them as best as possible while they execute improvement measures. Updates, alignment meetings, and encouragement for all involved. As things progress, keep them, and yourself informed on the progress being made in as structured an approach as you can.

Do you aspire to become the next CFO of the year?

If you are looking to manage your working capital, an experienced partner is your greatest ally. Get in contact to learn about the aioneers improvement approach, and how our AIO platform can support you in initiating and executing your working capital initiative.

* Side remark: Philipp Flemming and some of our aioneers were part of the consulting team that advised GEA in its working capital improvement initiative.