What Are Closing Costs For Buyers When Buying a House?

From the day you start idly looking through real estate listings to the moment you sign the last piece of closing paperwork, the process of buying a house typically takes months. Much needs to happen during that time: showings, making an offer, completing a loan application, appraisal, and inspection. It’s enough to overwhelm even the most organized buyer.

Buying a home isn’t cheap – and not just because your house is likely to be the largest single purchase you ever make. Closing on a home is a costly endeavor too. According to Zillow, U.S. closing costs typically range from 2% to 5% of the sale price.

The good news is that closing costs aren’t solely determined by geography, nor completely set in stone from the moment you choose a lender. It’s possible to shop and compare for some individual components of your total closing bill, such as title insurance, and to meaningfully reduce the cost of items that you aren’t permitted to shop around for. At the same time, you’re responsible for paying some items up front at closing, before they’re technically due. These are known as “prepaids,” and they typically include escrow expenses such as private mortgage insurance (when your down payment is less than 20%) homeowners insurance (hazard insurance), and property taxes. You will need to bring sufficient funds to the closing to cover your prepaids. (part of the closing cost numbers).

Definitions and Terms

Before getting into the essence of residential real estate closing costs, some definitions are in order:

- Loan Estimate (LE): This is a plain-language document that your lender is legally required to provide you 3 days after making your loan application. The loan estimate outlines all your best-guess estimates for closing items or estimated ranges for their actual costs. It also clearly indicates which items you’re permitted to shop and compare for. You will also receive your Home Tool Kit; describing at the length what I am writing here. 🙂

- Closing Disclosure Statement: This is the official summary statement of the real estate transaction, typically presented at least (3) three business days prior to the closing.The closing disclosure statement includes all Actual closing costs, plus the purchase price, down payment amount, and broker commissions.

- Paid Outside the Closing: This term, usually abbreviated “P.O.C.” on the closing disclosure statement, indicates what the buyer paid and the cost prior to closing. Some costs, including the first year’s homeowners insurance premiums, home inspection fees, appraisals, are frequently paid before the closing.

- Good Faith Deposit: When you put an offer in on a house, it’s customary to include a “good faith money” check to show that you are serious about the contract offer.

- Earnest Money: Typically is referred to as the “2nd deposit”. It is your down payment towards the purchase of your home. It can be as little as 3% of the purchase price offer and as much as you want to put down. A 20% down payment will avoid having an extra monthly cost payment foR private mortgage insurance. When the seller accepts the offer, the earnest money is deposited into an escrow account. When the transaction closes without incident, then the earnest money can be applied toward closing costs, reducing your out-of-pocket expense on closing day. If the transaction falls through, you usually – but not always – get the earnest money back.

- Commissions: The seller is responsible for paying them; it is split between buyers’ and sellers’ agents. Commissions are taken out of the sale price before the seller receives the proceeds.

There are numerous closing items your loan estimate is likely to outline, as well as some general tips to reduce your closing costs individually or in the total. While this is meant as a guide, your closing items and cost ranges could vary significantly from what’s described below, so it’s best to speak with a real estate agent , Gloria Benaroch or a real estate attorney before diving head-long into the buying process.

Closing Costs You Can Shop Around For After Choosing a Lender

Before you choose your lender, you theoretically have total control over your closing costs. Your choice of lender is therefore of great consequence – though, as your loan’s interest rate and terms are likely to impact your home’s final cost more than your closing costs, you shouldn’t choose a lender offering less-favorable rates or terms simply because they don’t charge as much for a home appraisal or happily waive the origination credit check fee.

These are the common closing costs that you can shop for after choosing your lender. Many are listed in Section C on page two of your loan estimate:

- Home Inspection. A home inspection is your best shot at catching a potentially costly defect or safety issue that wasn’t apparent during prior walk-throughs. If your inspection catches a serious problem (or multiple problems), you can negotiate your offer price, amend your offer to compel the seller to fix the issue, or walk away. The home inspection must use a qualified and certified inspector. Your real estate agent can give you some names. They have to give you at least (3) three names for you to choose from, or by checking with an industry association such as the American Society of Home Inspectors. Look at online reviews and testimonials for each, check references, and interview finalists if you’re on the fence about who to select. Be sensitive to cost, but remember that a lower price sometimes means lower quality. Make your final decision based on the optimal combination of cost and experience.

Cost: $300 to $600 for an average-sized house (1,500 to 2,500 square feet); more for larger homes. Payment is usually made directly with the inspector on the inspection date. - Title Search. Title searches, conducted either by title companies or real estate attorneys, are to make sure that sellers are legally able to sell their property. Initial title searches are known as an abstract of title. It is a comprehensive review throughout the property’s history. From its initial platting or subdivision to the present. In most cases they will go back 60 years of ownership. It identifies liens, covenants, easements, and other items that may affect the seller’s interest in the property, or its use to the buyer going forward. Title search costs are itemized on the loan estimate and closing disclosure statement. The best way to reduce them is to shop around for title insurance companies or attorneys, or negotiate directly with these service providers. Itemized cost idea

Cost: $250 to $600, and can be higher if the property’s history is more complex. - Title Insurance. There are two main types of title insurance: buyer and lender (loan) policies. Buyers customarily pay for both. Both cover the cost of fixing any title defects uncovered by the initial title search. Likewise both protect the lenders’ and the buyers’ interests in the property, in the event that title defects, covenants, or third-party claims are found to exist after the transaction closes.

Title insurance is a one time cost for the length of the ownership of the property. When you live there 40 years it is still in effect.

Lender and buyer policies remain in force until the respective parties no longer have interests (or own) the property – usually when the house is sold or, for lender policies, the mortgage is fully paid off.

Lender title insurance is mandatory, without title insurance, buyers have no financial recourse in the admittedly rare event that a legitimate claim arises against the property.

Title companies, real estate attorneys, and lenders recommend buyers’ insurers, frequently the same company that insures the lender’s policy.

NOTE buyers are free to shop around for their own policies – in fact, it’s illegal to force a buyer to use a particular title company. The American Land Title Association is a good comparison-shopping resource.

Cost: One-time title insurance premiums range from as little as $500 to more than $2,000 total for lender and buyer policies, depending on geography and the complexity of the property’s history. $1,000 is a good ballpark estimate. - Settlement Fee. The settlement fee pays for your title company’s or escrow agent’s services on closing day.

Cost: Typically $2 per $1,000 in sale price (e.g., $400 on a $200,000 house), but can be higher.

Closing Costs You Can’t Shop Around For

Once you choose your lender, you yield some control over your closing costs. These are the common closing costs you typically can not change after choosing your lender.

Many are listed in Section B on page two of your loan estimate:

- Loan Application Fee. Sometimes known as a “origination fee,” the application fee covers the cost of the initial loan application processing. Ask your lender directly whether the application fee includes the cost of a credit check. If it does, make sure you’re not charged separately for your credit report. Also, the application fee is sometimes bundled and is not listed separately, so don’t be surprised if you don’t see it – know that your origination fees will likely be higher as a result. Cost: $200 to $500.

- Loan Origination Fee. The loan origination fee covers the lender’s costs (and then some) during the underwriting process. It’s sometimes indicated as a single line item, and other times broken into several pieces (including application and processing). Majority of loans have origination fees, some lenders offer “no cost” loans which they make up in higher interest rates.

Cost: 0.5% to 1.5% of the home’s purchase price. Fees are typically expressed as “points,” with one point equivalent to 1% of the purchase price. - Loan Discount Fee. Lenders sometimes offer to reduce interest rates slightly in exchange for a sizable one-time payment – known as the loan discount fee – which is also expressed as “points.”

When your lender offers a discount fee, be sure to calculate whether it makes sense to take the deal. The upfront payment amount could be higher than what you will save over the life of the loan.

Cost: 0.5% to 4% of the loan value. As with the origination fee, one point equals 1% of the loan value.

Keep in mind that one point does not necessarily reduce your interest rate by 1% – the difference is much more modest.

when you choose to use discount fees, the full amount paid is tax deductible in the year you purchased your property. - Credit Report. Lenders often require buyers to pay for any credit reports ordered during the origination process. Sometimes they are willing to relent when buyers confidently and forcefully ask them to knock off their credit report fees.

Cost: $20 to $60, depending - Flood Certification and Monitoring. Flood certification fees cover the cost of pulling up and reviewing your area’s flood hazard maps to determine whether your home lies within a flood-prone area. Lenders sometimes charge an additional flood monitoring fee that covers the cost of maintaining an accurate measure of flood risk over time, as flood hazard maps can change frequently.

Flood certification is critical if you require flood insurance, so this fee is well worth paying. Prior to the “Super Storm Sandy” some properties did not require flood insurance and with the new FEMA maps they may be in a minimal flood zone.

Cost: Approximately $20 for flood certification; up to $50 for flood monitoring. - Appraisal. Lenders always order appraisals at some point during the underwriting process. Appraisals are conducted by outside certified appraisers, not bank employees.

The primary purpose is to ensure that homes’ value meets or exceeds the buyers’ offer price. Lenders are not willing to lend more than the value of the home, and are sometimes reluctant to lend at higher than expected loan-to-value ratios.

A low appraisal can be a serious roadblock to a deal.

The seller may take issue with a low appraisal and threaten to walk away from the deal. It’s not uncommon to order a second opinion (from a different appraiser) following a low appraisal.

Cost: $250 to $500; roughly double if a second appraisal is required. - Broker Fee. Buyers’ agent commissions come from the seller’s proceeds, you don’t have to worry about paying your agent’s compensation directly. Agents employed by brokerages or realty groups are usually required to collect a service or referral fee on their employer’s behalf. Cost: Widely variable –

- Recording Fee. City or county governments charge to record real estate transfers in the public record, an essential step in any real estate transaction.

Cost: Widely variable - Transfer Taxes. City, county, and possibly state governments charge transfer taxes on real estate transactions that occur within their jurisdictions, a function of local property values and local zoning. In New Jersey it is the seller that pays the Realty Transfer Fee. Like property taxes, transfer taxes are highly variable. Cost: Widely variable

- Mansion Tax. Buyers purchasing properties over $1million dollars are responsible for the mansion tax which is 1% of the purchase price.

Prepaids

You need to pay these costs in advance of closing. Note that you may also be required to deposit an upfront escrow buffer to cover unexpected upward adjustments in tax, insurance, and HOA expenses. The buffer can either be built into your total prepaids or broken out as a separate line item.

- First Month’s Interest. Lenders usually require advance payment of mortgage interest scheduled to accrue between closing and the first full mortgage payment (principal and interest) due date.

Cost: Up to one month’s mortgage interest, depending on the closing date (less when the closing is later in the month). - Homeowners Insurance Premium. Lenders always require proof of homeowners insurance prior to closing. Once you choose a policy, you can reduce cost by choosing a higher deductible. If you already have an insurance policy, such as auto insurance, consider bundling your new home insurance policy with the same insurance company – it may knock hundreds of dollars off your combined annual premium, relative to what you’d pay on two separate policies. You will pay your first year’s premium prior to the closing. When your home requires flood, earthquake, or other special hazard insurance, you will need to pay your first year’s premiums for those policies up front as well.

Cost: Widely variable, depending on factors such as geography, home construction and age, deductible, and property value. - Private Mortgage Insurance Premiums. Buyers planning to put less than 20% down payment or borrow more than 80% LTV of their homes’ value must pay for private mortgage insurance (PMI), which protects the lenders’ interest in the event of delinquency. PMI premiums are paid monthly out of escrow. Lenders require buyers to make advance payments to cover the first one to two payments part of the prepaids or escrow.

Cost: One to two months’ worth of PMI premiums, which are a function of home value and LTV ratio. - Advance Property Taxes. Advance property taxes are usually sufficient to cover property tax obligations (city and/or county) that accrue between closing and the first property tax due date, which can fall anywhere from less than one month to six months from closing. The advance tax amount can be greater when the lender requires it.

Cost: Widely variable. - Advance Homeowners Association Dues. Buyers in communities served by homeowners associations (including gated subdivisions and condo buildings) will pay advance homeowners/condo association dues through the end of the first payment period, which can last as long as a year. Lenders that bundle HOA dues into buyers’ escrow accounts add these advance dues to their buyers’ escrow balances. Buyers without escrow-paid HOA arrangements may be required to pay the HOA directly, in advance of closing.

Cost: Widely variable.

Homeowners insurance (hazard insurance) is considered prepaid, as you need to pay one year’s premium before closing.

Optional Closing Costs

Termite Damage

The common closing costs described above are required in most residential real estate transactions.

By contrast, some of the following costs are either required by law or deemed necessary by the buyer or advisable under certain circumstances – such as pest inspections where termites are common.

You can shop around for many of these items:

- Termite and Pest Inspection. Buyers are must spring for termite and pest inspections, Some not all lenders require this. The inspection can uncover latent or early-stage infestations before they get out of hand. In New Jersey this is an extra cost and is done during the home inspection

Cost: $50 to $150; more for larger homes and inspections covering a wider array of pests (such as rodents)

- Lead Paint Inspection. The United States outlawed lead paint in 1978. Homes built prior to 1978, could contain lead paint under layers of newer paint and it’s not always obvious. The Lead paint pamphlet , you should definitely consider an inspection if you have small children. In New Jersey the seller and the buyer must receive the lead paint pamphlet and also fill/sign the form.The buyer then has 10 days in which to do the lead paint inspection or they have the right to waive the inspection

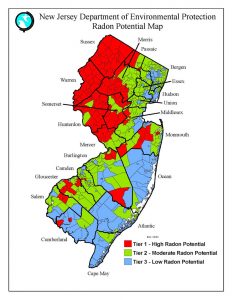

Cost: $300 to $500; more for larger homes. - Radon Testing and Inspection. Radon, is a radioactive gas that naturally occurs in certain types of bedrock, it is the second-leading cause of lung cancer in the U.S. Buyers in radon-prone areas are encouraged to test for radon during the home inspection, through a certified professional. New Jersey Map for Radon.When Radon

Cost: $75 and up for professional testing - Well Test. In semi-rural communities that do not have public water service, well tests confirm that water wells have adequate water flow, and that they are safe and pure for drinking. In New Jersey a water well test is done by the Seller. Lenders require proof of successful well tests prior to closing. Most plumbing and well-service companies offer well tests, as do some home inspectors.

Cost: Varied

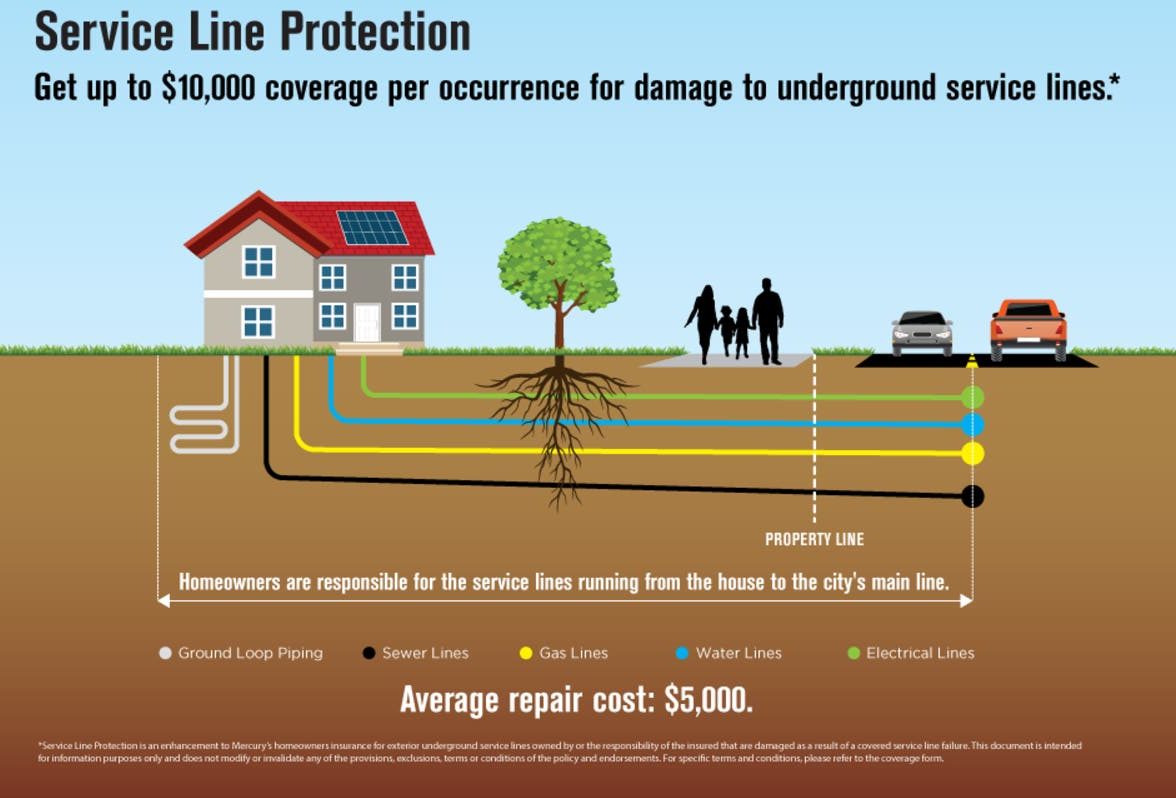

- Sewer and Water Line Sewer lines are famously prone to compromise, even in relativ

ely new homes. Untreated solid waste and inorganic debris clogs can seriously damage sewer lines. Sewer, and water line inspections aren’t necessary for newer properties and properties with recently upgraded water and drainage systems. Properties with red flags, such as mature trees perched directly above an outgoing or incoming line, are prime candidates for camera inspection by licensed plumbers.Inspections can pay for themselves many times over, as repair or replacement costs for damaged lines can exceed $5,000 – and may not be covered by homeowners insurance.Cost: $100 to $300.

ely new homes. Untreated solid waste and inorganic debris clogs can seriously damage sewer lines. Sewer, and water line inspections aren’t necessary for newer properties and properties with recently upgraded water and drainage systems. Properties with red flags, such as mature trees perched directly above an outgoing or incoming line, are prime candidates for camera inspection by licensed plumbers.Inspections can pay for themselves many times over, as repair or replacement costs for damaged lines can exceed $5,000 – and may not be covered by homeowners insurance.Cost: $100 to $300.

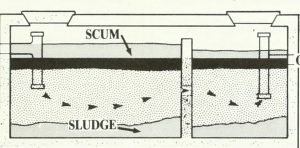

- Septic Inspection: Deep tree roots, untreated solid waste and inorganic debris clogs can seriously damage a septic system. Septic tanks need to be maintained by getting pumped out. Septic tanks are also set for certain amount of people living in the house.Replacing septic tank system can be over $8,000.

- Roof Inspection. A roof inspection is far more thorough than the educated glances roofs get during standard buyer-ordered home inspections. Roof inspections are recommended for buyers of older homes, especially when buyer-ordered inspections turn up potential roof issues.

Cost: Roughly $100 for average-sized homes; more for larger homes. - Fireplace Inspection A chimney should be inspected before buying a home and then at least every 12 months. Even if you use you rarely use your fireplace or stove, it is still recommended that you have your chimney inspected annually. A regular home inspector may look at the outside of a chimney and fireplace system, this type of external evaluation only determines if there is noticeable damage that pertains to the whole house structure. Using a certified chimney inspector (including but not limited to a home sale or transfer) will ensure your chimney is examined completely from top to bottom, inside and out. This includes the roof, video scanning of the flue interiors, the fireplace, and even areas where pipes travel through your home. In New Jersey some towns require a fireplace inspection as part of the certificate of occupancy.

Cost: $100 to $500 - Swimming Pool Inspection A thorough pool inspection should assure a potential buyer of several key issues, ranging from the elevation of the deck surface to the functionality of the pool pump. Swimming pools have a lot of complicated parts with which an inspector needs to be familiar, such as pumps, filters, and heaters. Many pools have additional equipment components and specialty accessories. Potential home/pool buyers check with their local chapter of the American Society of Home Inspectors (ASHI) for a referral to experienced swimming pool inspectors in their area.

Cost: $300 to $800 varies - Lender Inspection Fee. Lenders do not conduct their own home inspections on older homes. The appraisal is sufficient to determine existing homes’ value. Defects or safety issues fall under the“buyer beware” caveat. On the other hand New Construction home financing is a different matter. Lenders will request a new-home inspection before the closing date. The lender inspection is primarily to certify that the new home is finished and ready for safe occupancy. There is also a municipality inspection for a certificate of occupancy.

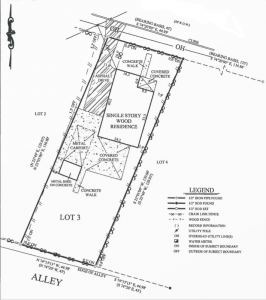

Cost: $50 to $150.  Survey Fee. It is VERY important to get a survey. Some lenders require surveys, which determine parcels’ precise boundaries and relationship to adjoining properties, locate improvements on the property, and identify easements that could impact future improvements (such as access roads or swimming pools). These must be completed by professional surveyors.

Survey Fee. It is VERY important to get a survey. Some lenders require surveys, which determine parcels’ precise boundaries and relationship to adjoining properties, locate improvements on the property, and identify easements that could impact future improvements (such as access roads or swimming pools). These must be completed by professional surveyors.

Cost: $250 to $500 for house location surveys; $500 to more than $1,000 for boundary (stakes)surveys.- Attorney Fees. In New Jersey real estate transactions are supervised by attorneys, amd sometimes by title companies or escrow agents. Buyers are typically responsible for paying their own attorneys. Attorney fees replace title company or escrow agent fees, and can be higher.

Cost: $500 to more than $1,000, depending on the complexity of the transaction and attorneys’ rates. - Notary Fee. This fee, usually charged by a title company or escrow agent, covers a notary’s sworn testimony that the parties to the transaction are who they say they are and that the transaction occurred and was recorded.

Cost: Usually less than $50. - Courier Fee. If they wish to expedite document delivery for closing day, title companies or escrow agents bill buyers for the necessary courier costs. This is a fee that settlement agents are often willing to waive if pressed.

Cost: Usually less than $30.

Close at or Near the End of the Month

This is a strategy that actually works. By closing in the last week of the month, buyers can reduce the prorated mortgage interest share due at closing. On a loan that accumulates $20 interest every day, the buyer saves $500 by pushing closing back from the 1st day to the 25th day of a 30-day month.

Roll Closing Costs Into Your Loan Principal

Some lenders offer loans that roll closing costs into the principal, effectively financing them at your mortgage rate over the life of the loan. Rolling closing costs into your loan principal doesn’t actually reduce the amount paid toward your closing costs. In fact, it’s likely to increase the total cost of your home over the life of your mortgage, due to a larger principal and possibly a higher interest rate. It can dramatically reduce what you need to pay at closing.

Rolling closing costs into your loan is a good strategy if your loan amount is well below the home’s appraised value, meaning the additional principal won’t push your LTV above a level the lender is comfortable with. If the additional principal does push your LTV above 80%, you’ll be on the hook for a monthly PMI payment.

Rolling closing costs into your loan principal also makes sense if you’re planning to sell within a few years. Since monthly interest payments are higher with a rolled loan (due to a higher principal or higher interest rate), selling relatively early in your loan’s term reduces your total interest expense and mitigates the final cost of rolling your closing fees. On the other hand, when you remain in your new home for decades, rolling closing costs into your loan might not make financial sense.

Take Advantage of Military Benefits (VA Loans)

Are you in the military, or were in the military and honorably discharged? There’s no reason to overlook the financial perks of the service.

VA loans are available to active-duty military members (after six months of service, except for National Guard and Reserve members), veterans, and spouses of service members who died on active duty or as a result of a service-connected disability. They come with some attractive financial benefits, such as the ability to originate a loan with no down payment. What’s more, regulations governing VA loans prohibit lenders from charging certain closing costs.

Consider a Lower Down Payment

Reducing your down payment can free up lots of closing cash. There are two catches here.

First, the seller has to accept your offer. Sellers tend to favor offers with higher cash down payments, and they could view your offer with skepticism – especially when the local market is hot and the seller has multiple offers.

The other consideration is private mortgage insurance. The higher your LTV ratio, the longer you’ll be on the hook for PMI, which you’re required to pay until you approach 80% LTV.

My Final Thoughts

You can expect closing costs to account for up to 5% of your home’s purchase price. The share of your costs paid up front, over time, or by others will depend on your ability to act on the tips described here. That ability, in turn, is likely to depend in part on factors beyond your control, such as the seller’s motivations and your local market’s temperature.

Once you accept that it’s not always possible to have total control over the closing process, you’ll be more calm about the whole transaction– and focus on trimming the expenses which you do have some control of.