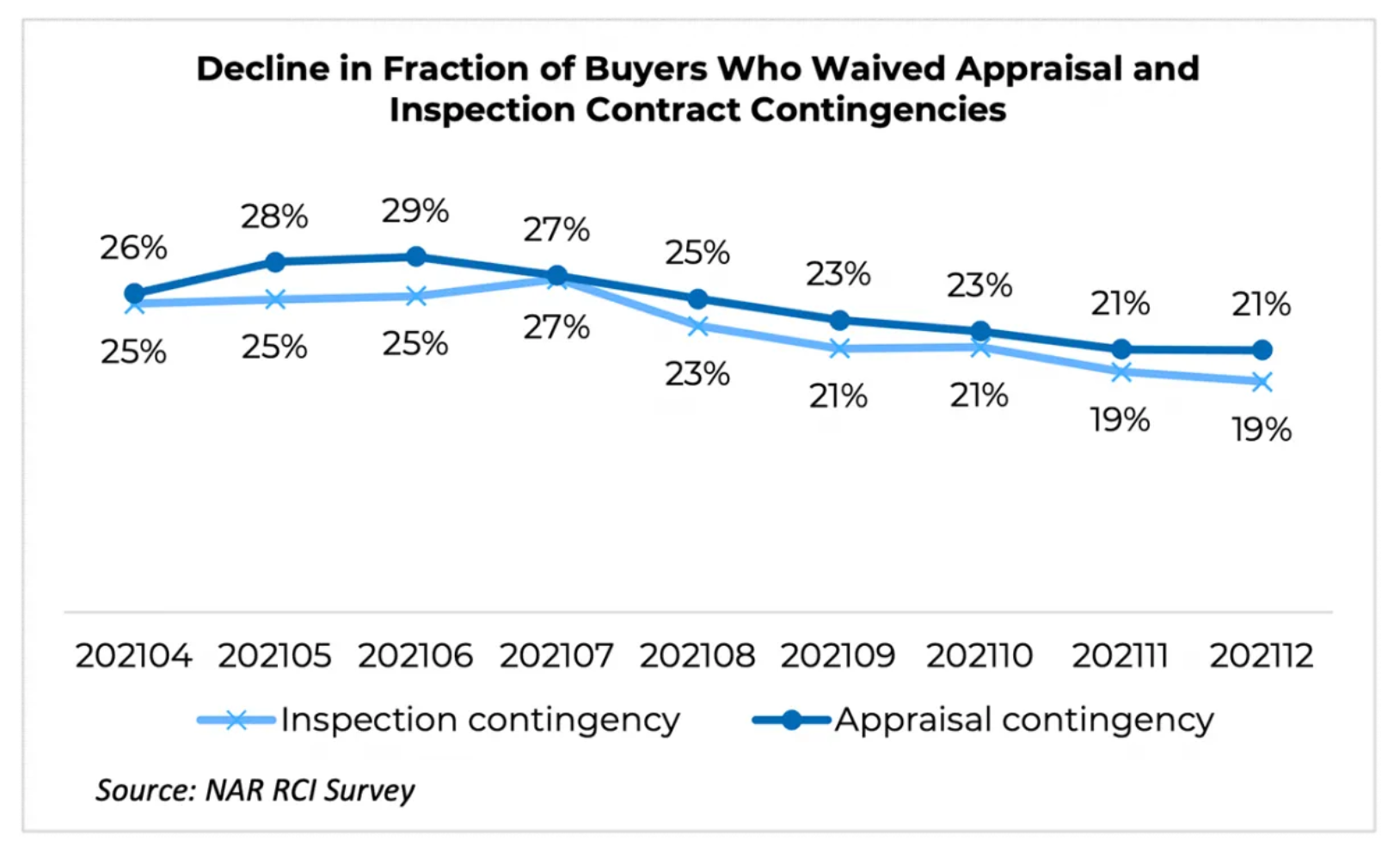

Home shoppers are showing less willingness to waive appraisals, home inspections, or other contract contingencies during the purchase of a home compared with just a few months ago, according to the December 2021 REALTORS® Confidence Index Survey, a survey of REALTOR® transactions conducted by the National Association of REALTORS®.

Nineteen pe

rcent of buyers waived the inspection contract contingency in December, down from a peak of 27% in July 2021, NAR’s survey shows.

Twenty-one percent of buyers waived the appraisal contract contingency, down from a peak of 29% in June 2021.

Buyers also were less willing to waive other contract contingencies, like a financial contingency (10%), a home sale contingency (8%), or a title contingency (1%).

“With home prices continuing to rise, buyers are making sure they are getting their money’s worth,” Gay Cororaton, an NAR researcher, writes on the association’s blog.

The median existing-home sales price increased to $358,000 in December 2021, marking a jump of nearly 16% year over year, according to NAR’s data.

Another possible reason buyers are less willing to waive contingencies is that appraisals appear to be moving faster, Cororaton says. “With the onset of the pandemic, appraisal issues accounted for a higher fraction of contract settlement delays, from about 15% prior to the pandemic in January 2020 to a peak of 27% in July 2021,” she writes. In the past three months, appraisals comprised just 22% of contract settlement delays for comparison.

“The decline in buyers who are waiving appraisal and inspection contingencies is a healthy trend,” Cororaton writes. “Buyers should pay for what a home is worth and be informed of potential issues that need to be addressed by the seller or anticipated by the buyer if the buyer wants to take the responsibility for addressing this issue at their own cost.”