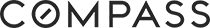

Foreclosure-related filings were down sharply from a year ago nationwide in August despite an increase in foreclosure activity in 20 states, particularly in states where courts handle the foreclosure process, including New Jersey, New York, Maryland, Illinois and Pennsylvania.

According to the latest numbers from data aggregator RealtyTrac, 193,508 homes were hit with foreclosure-related filings last month, including notices of default, auction notices and bank repossessions. That's an increase of 1 percent from July, but a 15 percent decrease from a year ago.

Foreclosure starts were up 1 percent from July to August, with 99,405 homes entering the foreclosure pipeline, down 13 percent from a year ago. Bank repossessions were also down on a year-over-year basis for the 22nd month in a row, RealtyTrac said. Lenders repossessed 52,380 homes in August, down 2 percent from July and 6 percent from a year ago.

Source: RealtyTrac

Bucking the national trend, foreclosure-related filings "boiled over" in August in several states where courts handle the foreclosure process, including Illinois and Florida, said Daren Blomquist, vice president of RealtyTrac, in a statement.

An increase in short sales and foreclosures was predicted in judicial foreclosure states after the nation's five largest mortgage servicers reached a $25 billion settlement in March over "robo-signing" allegations.

While foreclosure-related filings were down 31 percent collectively from a year ago in the 24 nonjudicial states and District of Columbia, some judicial foreclosure states saw big annual increases in foreclosure activity, led by Kentucky (up 73 percent), New Jersey (up 65 percent), New York (up 56 percent), and Maryland (up 54 percent).

Foreclosure-related filings were up from a year ago in 20 states in August, including Illinois, which posted the highest rate of any state with 1 in every 298 housing units. A total of 17,781 Illinois properties were subjected to a foreclosure-related filing in August, — a 42 percent increase from a year ago.

Florida climbed to second on RealtyTrac's list of states with the highest rate of foreclosure-related filings, with 1 in 328 properties subjected to a filing.

Until August, the top two spots on the list have been held by one of four nonjudicial foreclosure states since December 2010: Arizona, California, Georgia and Nevada.

10 states with highest foreclosure rate

| Rank | State | August 2012 Properties with Foreclosure Filings | 1/every X Housing Units | Percent change from July 2012 | Percent change from Aug. 2012 |

| 1 | Illinois | 17,781 | 298 | 29.09 | 42.33 |

| 2 | Florida | 27,422 | 328 | 7.39 | 16.35 |

| 3 | California | 40,200 | 340 | -4.47 | -32.30 |

| 4 | Arizona | 7,899 | 360 | -3.87 | -28.72 |

| 5 | Nevada | 2,921 | 402 | 3.33 | -69.82 |

| 6 | Georgia | 9,478 | 431 | -12.73 | -19.29 |

| 7 | Ohio | 9,218 | 556 | -5.15 | -6.33 |

| 8 | Michigan | 7,648 | 593 | -12.66 | -41.24 |

| 9 | Delaware | 665 | 610 | 180.59 | 1.68 |

| 10 | Colorado | 3,584 | 617 | 24.66 | -27.35 |

Source: RealtyTrac