Home Sales Showing Signs of Price Fatigue

The concept of ‘price fatigue’, which occurs when the cost of housing increases at a faster pace than wages.which occurs when the cost of housing increases at a faster pace than wages. The most common causes for such increases are rising interest rates and home prices.

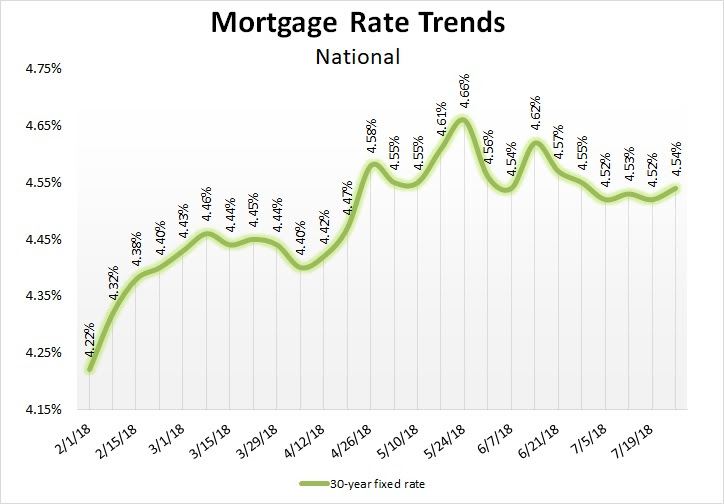

The interest rate on a 30-year fixed rate mortgage has risen over the past year from 3.92% to 4.54%. Given the 9:1 ratio of mortgage rates to purchaser power, this increase is the equivalent of a 5.6% home price increase. Adding this to the 5.2% increase in New Jersey home prices over the past year indicates that the cost of home ownership has risen by 10.8% for the same house.

On the income side of the equation, total wages and salaries have increased by only 3.5% over the past year. Therefore, the 10.8% rise in home-ownership costs has been more than double the rise in wages.

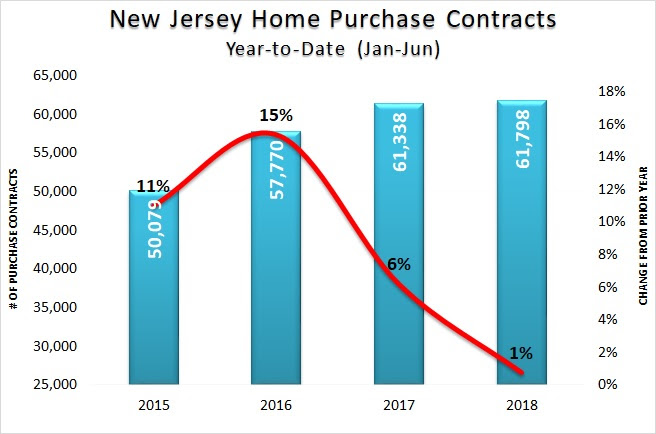

This tells us that the cost of home-ownership is rising faster than the public’s ability to afford that increase. During the month of June, however, purchase contracts contracted by 1% in comparison to the prior year. While this is partially attributable to an under-supply of housing inventory, the affordability gap is also a significant factor.

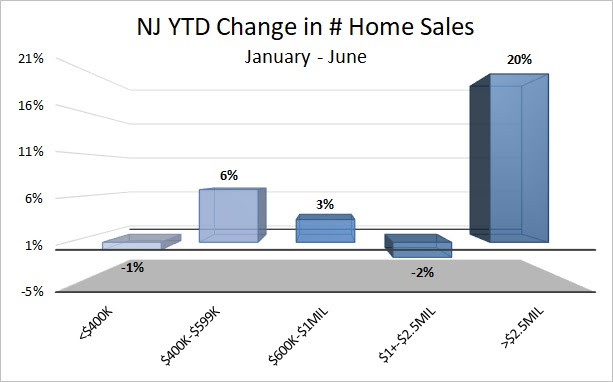

Contract activity for luxury priced homes over $2.5-Million has increased by an impressive 20% (170 in 2017 vs. 204 today)

Contract activity for luxury priced homes over $2.5-Million has increased by an impressive 20% (170 in 2017 vs. 204 today)Inventory remains restricted, which is limiting choices for home buyers. The number of homes being offered for sale today in New Jersey has fallen to its lowest point since 2005,

Monmouth county has fewer than 4 months of supply.

Commitment rates for the 30-year fixed rate loan have remained relatively stable throughout the month of July, averaging 4.53%, down from a 4.57% average in the month of June.

Commitment rates for the 30-year fixed rate loan have remained relatively stable throughout the month of July, averaging 4.53%, down from a 4.57% average in the month of June.According to Freddie Mac, affordability pressures are an increasing concern in many markets, as the combination of home price gains coupled with higher mortgage interest rates seem to be giving more prospective buyers a pause. As a result, new and existing-home sales at the national level have slowed and unsold inventory has risen, despite the healthy economy and labor market.