What’s the Difference Between a Hard and Soft Credit Check?

We may be compensated when you click on links from one or more of our advertising partners. Opinions and recommendations are ours alone. Terms apply to offers below. See our Advertiser Disclosure for more details.

When a lender or creditor is considering offering you a line of credit or a loan, they’ll check your credit to help determine whether or not to lend you money.

These inquiries can take the form of a hard inquiry, which does affect your credit score, or a soft inquiry, which does not. The type of credit inquiry performed will depend on the person or company pulling your credit information.

In this article, we’ll explain the differences between the 2 types, give you some common examples of both, and let you know how much each type will impact your credit.

TABLE OF CONTENTS [SHOW]

What Is a Hard Credit Check?

A hard inquiry (or hard pull) is used to determine whether or not you’re eligible to be given a loan or credit card. If you apply for credit — like a mortgage, auto loan, or credit card — the lender will check your credit report and credit score from 1 or more of the major credit bureaus.

When a company requests a hard inquiry on your credit, it will receive your entire credit report, which will show things like lines of credit, loans, your payment history, and any amounts that went to or are currently in collections. It can also include additional places that you might have applied to get credit — whether that’s a car loan, mortgage, student loan, or credit card.

Because these inquiries are tied to an actual credit application, they’re considered hard inquiries, and they can affect your credit score. Your permission (via credit card application, mortgage application, etc.) is required for lenders to make hard inquiries on your credit. These pulls can lower your score, especially if you have several of them within a short time span. Credit inquiries make up 10% of your overall FICO score.

Who Uses Hard Inquiries?

Hard inquiries are used by companies to make sure you’re likely to pay back the loan you’re requesting or the lease you’re signing.

Here are the most common users of hard inquiries:

Lenders and Credit Card Companies

Lenders and credit card companies use a hard inquiry to make an informed financial decision on whether or not to loan you money or a line of credit. This will be the case whether you’re applying for a mortgage, a student loan, or a new credit card.

One exception is with some banks that have specific requirements, such as “receiving a bonus within the past 48 months” or Amex’s “1 bonus per card per lifetime” policy. If you’ve been denied a credit card based on these reasons, you usually won’t see a hard inquiry show up on your credit report. This is because banks typically use the information they have on file for you to conditionally approve or deny you prior to pulling your credit.

Landlords

Landlords can choose to run either hard or soft credit inquiries. Usually, when you submit an application for an apartment, the landlord will include a form that will ask your permission to run a credit check. Some landlords go through third-party background and screening companies who do a hard pull since you must give your Social Security number.

This isn’t always the case as landlords can choose to use services offered by 1 of the 3 major credit bureaus instead. These are considered soft pulls and the landlord will receive a modified report.

Common Hard Inquiries

The most common hard inquires will occur when you submit:

- Apartment rental applications

- Auto loan applications

- Credit card applications

- Mortgage applications

- Personal loan applications

- Student loan applications

How Hard Inquiries Impact Your Credit Scores

Applying for a credit card or a loan will result in a hard inquiry on your credit report. As we noted earlier, inquiries make up 10% of your overall FICO score.

But how will your overall score be impacted? Well, 1 hard inquiry might lower your score from 0 to 5 points, depending on your credit history. If you have even more inquiries, this will be further magnified. In general, once you hit 7+ inquiries on your credit report, you should expect to see a significant drop of 50+ points in your credit score.

This shouldn’t be a reason to avoid applying for credit since a hard inquiry is required to get the credit card or loan that you want. If your score is high enough, it will have little impact (if any) on your creditworthiness.

Problems arise when you have too many hard inquiries in a short period of time. This can be concerning to lenders since it’s a sign of poor money management — opening a lot of new credit accounts may mean you’re having trouble paying bills and are at risk of overspending.

Bottom Line:Unfortunately, there isn’t a simple answer to how much your score will be impacted by a hard inquiry — this will vary based directly on your individual credit history and the number of inquiries on your credit report. The good news is that unless you are carrying out multiple hard checks, it’s unlikely to have much of an impact in the long term.

How “Rate Shopping” Is Treated

What do you do if you’re looking to get a mortgage or an auto loan and want to make sure you’re getting the best rate? The good news is that rating agencies understand that several inquiries in a short period of time (30 days per FICO’s scoring model) are common when looking for the best rate, and they’ll group those inquiries into a single hard inquiry on your report.

Note that this occurs only if the inquiries are for 1 category of qualified loans — a mortgage, auto loan, or student loan. While a hard inquiry will always impact your credit score, this grouping of inquiries results in a smaller impact than multiple, separate inquiries.

Hot Tip:Hard inquiries are rarely the reason you might be denied credit since they don’t affect your credit score as much as other factors like credit utilization and length of credit history.

How Long Inquiries Stay On Your Credit Report

We recommend checking your credit report at least once a year to ensure that all of the information is accurate. You’re entitled to 1 free report per bureau per year through AnnualCreditReport.com. These reports will show all of your financial accounts along with any hard inquiries on your report.

Hard inquiries remain on your credit report for just over 2 years, but FICO weighs them less as time passes. Even if you have multiple hard inquiries in a span of just a few months, it’s still unlikely a potential lender will give them too much consideration.

How To Dispute Inaccurate Hard Inquiries

If you’re checking your credit report as we’ve recommended above, be sure to look for any inquiries you don’t recognize. This could be a sign that someone may have applied for a fraudulent credit account in your name. Also, simple errors in classification can happen.

Either way, if you spot an erroneous pull, notify the credit bureau immediately to dispute it. Write a letter explaining the error and include a copy of your report with the error highlighted or circled.

The bureau will investigate and respond within 30 days. Credit bureaus are legally required to remove the hard inquiry from your report if it is inaccurate, and once it’s removed, you should see your credit score return to its prior level. You should also reach out to the financial institution that ran the credit check to let them know that you did not request it.

Hot Tip:Read our complete guide on how to dispute errors on your credit report.

What Is a Soft Credit Check?

A soft inquiry (or a soft pull) shows the same information that we’ve noted above for hard inquiries. This includes lines of credit, loans, your payment history, and any amounts that went to or are in collections.

Unfortunately, due to the nature of soft inquiries, they can occur without your permission. The good news is that because soft inquiries aren’t tied to any applications for credit that you’ve done yourself, they’re only visible on your own credit report with a few exceptions:

- Insurance companies may be able to see other insurance companies’ soft inquiries.

- Inquiries by debt-settlement companies you have authorized to access your report may be shared with your current creditors.

Who Uses Soft Inquiries?

Since soft inquiries don’t require your approval, it’s important to know who can access them — here are the most common users of soft inquiries:

Yourself

The most common instance of a soft inquiry would be when you monitor your own credit report. This includes services you use to monitor your credit score, like Credit Karma (review) or Mint. These can be pulled weekly, monthly, or as you request them.

Employers

The modified credit report that potential employers see is not the same report that you (or even other lenders) see. According to a 2018 HR.com report, 16% of companies pull credit or financial checks on all job candidates and almost 33% do credit checks on some candidates.

Credit Card Companies

Credit card companies are often the biggest users of soft inquiries — and they usually happen without your approval. This is because they use these soft pulls as a way to see if you’re prequalified for a credit card. Similar to what an employer sees, credit card companies won’t see information like your account numbers but will see things like your payment history and if you have any accounts in collections.

The companies will then send you the offers that might appeal to you to try to entice you to sign up for a new card. This can definitely get annoying (and take up plenty of space in your inbox!), but companies are hoping that one of the offers you see might catch your eye and will be too good to pass up.

Insurance Companies

If you get auto insurance, homeowners insurance, or any other insurance quotes in the mail, this will also involve a soft pull. Again, these happen without your authorization and are used to give you an accurate quote based on your credit history.

These insurance companies don’t see your regular credit score, but rather what’s called a credit-based insurance score. They see a score that’s similar to your FICO score but is weighted a little differently.

Pre-employment Soft Credit Checks

While you might expect insurance and credit card companies to check your score, it could come as a surprise to see that employers also perform this somewhat sensitive background check. Let’s take a closer look at what is and isn’t permitted, as well as how to be prepared for the situation.

What Will a Prospective Employer Look For?

Potential employers often use credit checks as a way to determine if you’re a responsible person. They can see information such as your mortgage, outstanding balances, auto or student loans, late or missed payments, bankruptcies and foreclosures, and accounts that have gone to collections.

Having some negative items on your credit report doesn’t mean you won’t get the job, but lots of late payments or bills in collections can let employers know that you have a hard time staying organized with your money. While they’ll be able to see information dating back 7 years, more recent information will typically be weighted more heavily in any decisions they make.

What Positions Do Credit Checks Apply To?

An employer can run a credit check for any role if they wish, although it is unlikely to have too much impact on their final decision unless you’re applying for a role that requires you to regularly handle money.

Jobs where your credit score might have more of an impact on an employer’s choice to hire you or not include:

- Finance management

- Banking

- Accounting

- Retail jobs

A bad credit report will not automatically deny you a role in any of these industries, but it might make it harder for a prospective employer to know they can trust you.

What Is the Process?

The check will take place once an employer is prepared to offer you a job (or, as is sometimes the case with current employers, a promotion). They’ll reach out to a third-party company to perform a check on your financial history.

The report itself will be carried out in much the same way as if you yourself were checking your own score. The employer will be provided with financial factors such as:

- Credit and debit card debt

- Mortgage payments

- Loan repayments

- The late payment of debts

- Any cases of bankruptcies

Despite seeing this relatively sensitive information, an employer will be restricted from gaining access to most of your personal data. For example, your date of birth will not be included, so as to prevent any kind of age discrimination when assessing your application.

What Are Your Rights?

The Fair Credit Reporting Act (FCRA) protects your rights and makes it so that employers must have written consent before pulling your credit history. This might be done as part of your application process, or they may ask for your permission later on in the interview process.

This modified credit check won’t show your credit scores or any account numbers. It also won’t show any information that could violate equal employment regulations, like your birth year or marital status.

In addition, there are some cities and states that restrict credit checks as part of the decision for employment:

- California

- Chicago

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Hawaii

- Illinois

- Maryland

- Nevada

- New York City

- Oregon

- Philadelphia

- Vermont

- Washington

How To Be Prepared for Pre-employment Checks

While you won’t be able to make drastic changes to your credit score in the time between applying for a job and any potential pre-employment check, there are steps you can take to be as prepared as possible for any tricky questions.

- Understand your score. Put the power back in your hands by gaining a detailed understanding of your own score. If you think your report might not represent you well, form responses as to why that might be the case. An employer may be willing to overlook a poor score if you can clearly highlight how it has no bearing on your job performance.

- Check for errors in your report. Checking your score before you apply also gives you the chance to identify and dispute any errors which may have been falsely included. You’ll be given the chance to file a 100-word statement that disputes any misinformation, which an employer should be able to see when carrying out a check. Even if a lender doesn’t agree with your statement, it can go a long way to looking better in the eyes of a prospective employer.

- Think about where you’re applying. The weight an employer places on your credit score will naturally vary, depending on a number of factors. Chief amongst those is the sector you’re applying to, as well as the size of the company in question. If you’re worried your credit score is going to impact your application, think about applying to smaller companies, which are more likely to overlook a bad report.

Bottom Line:Employers don’t always run your credit, but if your job involves company finances, it’s likely they will.

Common Soft Inquiries

As a quick recap, the most common soft inquiries will happen when:

- You check your own credit score (annual or continuous monitoring)

- Employers run your background check

- Companies “prequalify” you for a credit card or insurance

How Soft Inquiries Impact Your Credit Score

While hard and soft inquiries show the same information, the main difference is that soft inquiries have no effect on your credit score. They aren’t even built into any credit-scoring models!

Soft inquiries are also not disputable. However, remember that potential lenders won’t be able to see them (except for insurance companies and debt-settlement companies as we’ve noted earlier).

How To Know if an Inquiry Will Be Hard or Soft

The difference between a hard and soft inquiry comes down to whether you gave the lender permission to check your credit or not. If you did, it will likely be reported as a hard inquiry. By signing a document, such as a credit card application, loan application, etc., you’re giving the company permission to pull your credit. If you didn’t sign any documents or otherwise approve a credit inquiry, it should be reported as a soft inquiry.

There are other types of credit checks that could show up as either a hard or soft inquiry. For example, utility, cable, internet, and mobile providers will often check your credit. If you’re unsure how a particular inquiry will be classified, you can always ask the company, credit card issuer, or financial institution to clarify before you sign any documents or turn in your application.

Managing Your Credit

Try to keep hard inquiries on your credit to a minimum since it can signify that you’re over-extending your finances and aren’t a reliable borrower. You don’t want your credit score to suffer by applying for too many credit cards or other loans.

Apply for Loans Sporadically

The easiest way to keep credit inquiries from affecting your score is to manage how often you’re applying for loans or lines of credit. Be mindful of opening a lot of new credit accounts within the 2-year window when inquiries show up on your credit report. If possible, wait until some inquiries drop off before applying for additional credit.

In addition, shopping for multiple rates within 30 days is grouped together and treated by FICO as 1 inquiry. If you’re shopping for the best rate for a mortgage, car loan, etc., try to do all of your loan applications within this timeframe.

Avoid Getting Denied

While the denial itself won’t hurt your score any more than an approval, you may still see a drop in your credit from the hard inquiry. One of the worst things would be to have this hard inquiry show up on your account and not even be approved for the loan or credit card!

Be aware of the loan or card requirements. If you’re knowledgeable about your current credit score, you can try to only apply for the loans or credit cards that you feel reasonably sure you’ll qualify for.

Improve Other Aspects of Your Score

While credit pulls can lower your score by 3 to 5 points (per inquiry), this doesn’t have a huge effect on your credit. Your credit utilization makes up a much larger chunk of your credit score. There isn’t 1 magic percentage to hit, but the lower you keep it, the better. That means you shouldn’t be spending up to the maximum of your credit line each month.

The length of your credit history is also an important contributor to your credit score. This is important to remember when you’re considering closing some of your older credit and loan accounts.

Check Your Credit Frequently

Checking your own credit report regularly will never affect your credit and it can help you keep up to date on any major changes to your score. You can also monitor for any hard inquiries in case you need to dispute an erroneous item.

Also, keep in mind that each of the 3 reports could have different inquiries, as an inquiry is only added to the specific credit report that was checked. For example, if you check your Equifax credit report, the soft inquiry won’t be added to your Experian or TransUnion credit reports.

Consider Soft Pull Credit Card Approvals

There are a few credit card issuers that perform a soft inquiry (as opposed to a hard inquiry) when you apply for a credit card. These cards are generally targeted at those individuals with bad credit. The issuers do a soft inquiry to confirm your identity, but it’s still possible that they’ll have to do a hard inquiry if they need to gather more information.

Before you consider a card that doesn’t require a hard pull, make sure you do your research and read the fine print carefully. There are usually higher APRs and harsher penalties for missing payments attached to these cards.

Freezing Your Credit

By placing a freeze on your credit, hard inquiries can’t occur, stopping any new accounts from being opened in your name. This might be a good option for you, especially if you’ve been the victim of identity theft or a data breach.

Not sure if a credit freeze is right for you? Here’s more information about what it means to freeze your credit (and when it’s a good idea).

Hot Tip:Keep in mind that while hard inquiries can be stopped by freezing your credit — soft inquiries can’t.

Top Credit Statistics for 2021-2022

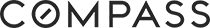

Average Credit Score by Age

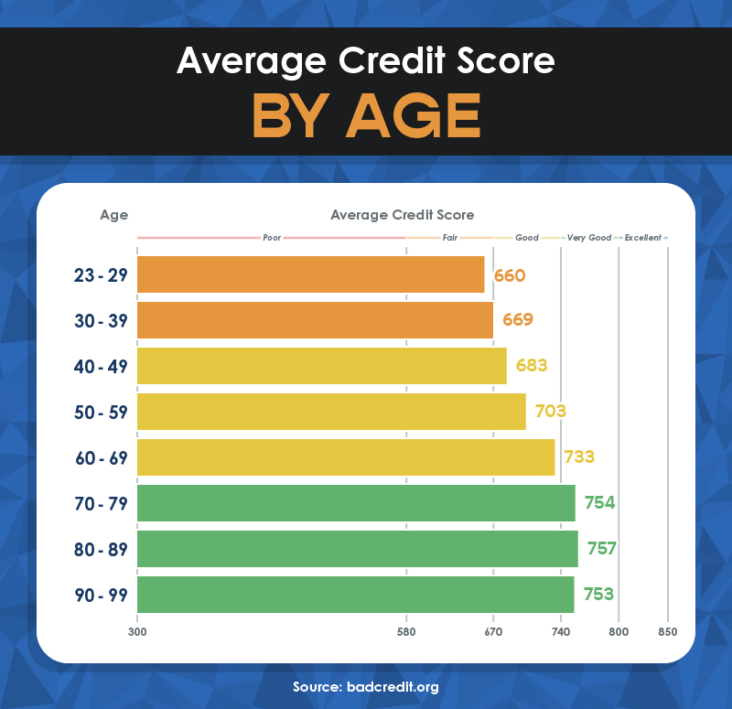

As of August 2021, the average credit score for an American citizen was a respectable 716 – placing them comfortably in the “Good” bracket. This was 8 points higher than the last reported average (in October of 2020).

Interestingly, although perhaps to no great shock, it seems the more experience you have under your belt has a positive impact on your score. Statistics showed that the 3 best average scores by demographic were for those aged 70 to 79, 80 to 89, and 90 to 99.

Average Credit Score by State

When it came to the U.S. state with the best average score, Minnesota led the way with an average of 739. The top 5 best scores across the country were:

- Minnesota – 739

- Wisconsin – 732

- South Dakota – 731

- Vermont – 731

- North Dakota – 730

Meanwhile, at the other end of the spectrum, the states which had the lowest scores on average were:

- Nevada – 695

- New Mexico – 694

- Arkansas – 690

- Oklahoma – 690

- South Carolina – 689

Average Credit Score

Encouragingly, when it came to the bracket which most Americans found themselves in (as of April 2021), the highest percentage were those in an “excellent” score of 800 to 850. The full breakdown showed:

- 300 to 499 – 3%

- 500 to 549 – 5.4%

- 550 to 599 – 7.1%

- 600 to 649 – 9.2%

- 650 to 699 – 12.5%

- 700 to 749 – 16.4%

- 750 to 799 – 23.1%

- 800 to 850 – 23.3%

With trends continuing to show an improvement in scores of the average American, it will be interesting to see how long this healthy period sustains.

Additional Resources

If you’d like to find out more about hard and soft credit checks, as well as how you can optimize your credit report as best as possible, be sure to check out these handy secondary sources:

- Equifax assess 5 things that will negatively impact your credit score

- Investopedia provides tangible advice on how to improve your credit score

- The Muse provides a detailed list of actionable advice for managing your finances

- Wells Fargo provides advice on how to easily check your score

- Check out our extensive list of credit report statistics for the 2021 financial year

Profiles To Follow for Financial Advice

While you probably have a better footing for how your credit score will be affected by different checks, it never hurts to follow some reliable sources for up-to-date advice. Here are some of the best Twitter accounts to keep up with for advice on your credit report:

- Credit Score Secrets — A great profile that provides interesting new ideas on helping your credit score.

- Credit Sesame — A great resource for growing your score.

- Debt.com — A profile with resources to help people fix credit card debt, tax debt, student loan debt, credit report errors, ID theft issues, bankruptcy, and more.

- George Daunis — George shares wisdom on subjects such as boosting your credit score, home buying, being a landlord, blogging, social media, and online income generation.

- How To Raise My Credit Score — Enjoy advice from credit repair experts who can help get your finances back on track for the future ahead.

- Lexington Law — This group believes in your legal right to a fair, accurate, and substantiated credit report.

- OneScore — This profile is from a great app to check and improve your credit score for free.

Final Thoughts

Both soft and hard credit inquiries are done to assess the state of your credit. Soft inquiries are done constantly to track your own credit score or by companies to preapprove you for credit cards or loans. These won’t affect your credit.

It’s very important to monitor and manage any hard inquiries you have to your credit report. Hard inquiries are necessary to get approved for many types of loans and can even be performed by your future employer to see if you’re a good candidate. These can affect your credit score and stay on your credit report for 24 months.